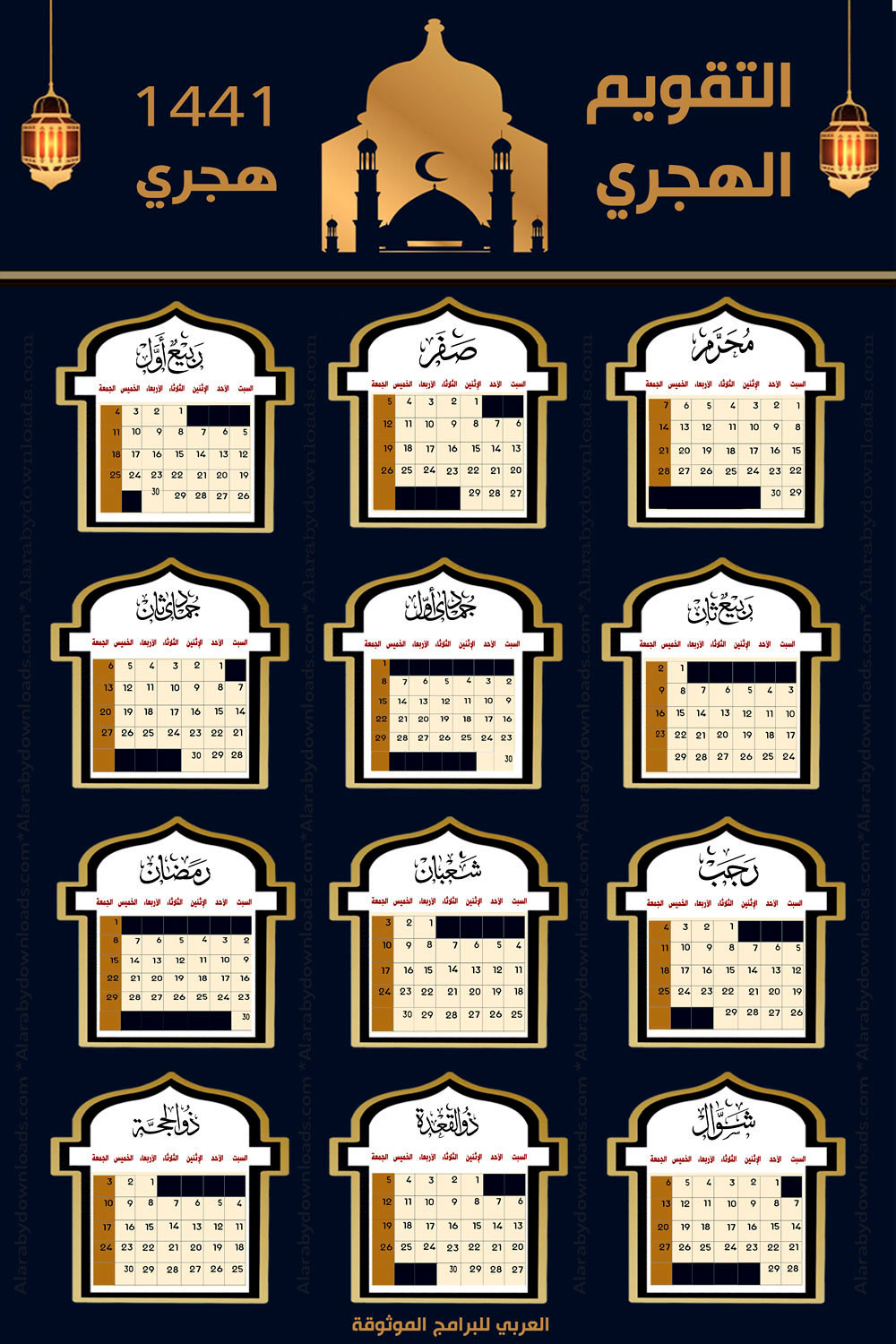

تحميل التقويم الهجري 1441 والميلادي 2019 pdf + صورة كم التاريخ الهجري والميلادي اليوم ؟ | Free business card design, Calendar, Business card design

تحميل التقويم الهجري 1441 والميلادي 2019 pdf + صورة كم التاريخ الهجري والميلادي اليوم ؟ | Calendar, Periodic table

تحميل التقويم الهجري 1441 والميلادي 2019 pdf + صورة كم التاريخ الهجري والميلادي اليوم ؟ | Calendar, Periodic table

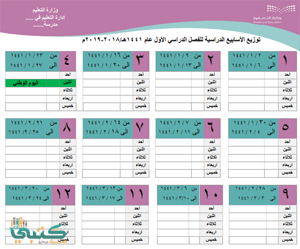

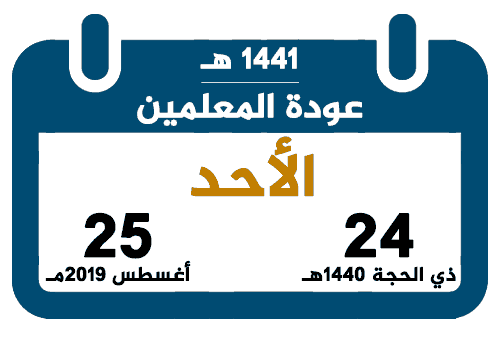

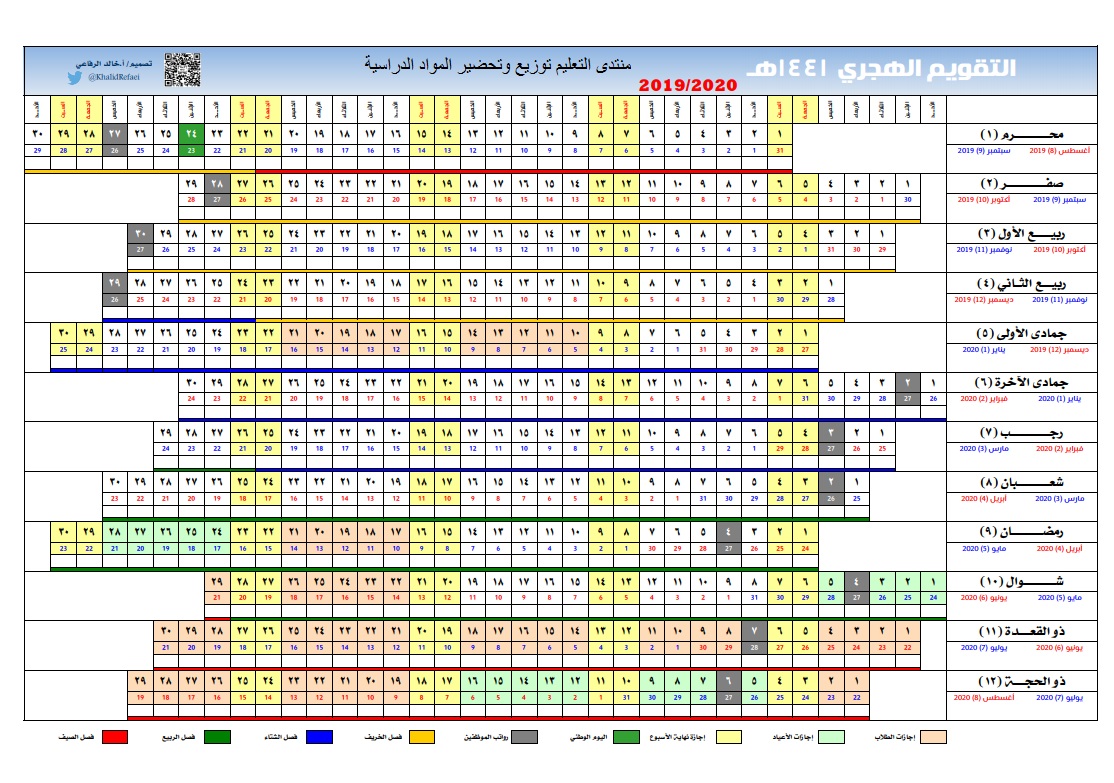

منتدى التربية والتعليم توزيع وتحضير المواد الدراسية: هنا التقويم الهجري و الميلادي و عودة المعلمين و الطلاب و الاجازة لعام 1441 - 2020 جودة عالية PDF

هنا التقويم الهجري و الميلادي و عودة المعلمين و الطلاب و الاجازة لعام 1441 - 2020 جودة عالية PDF - منتدى التعليم توزيع وتحضير المواد الدراسية

تحميل التقويم الهجري 1441 مع الإجازات كم تاريخ اليوم بالهجري ؟ التقويم الهجري 1441 PDF % | Hijri calendar, Calendar, Periodic table