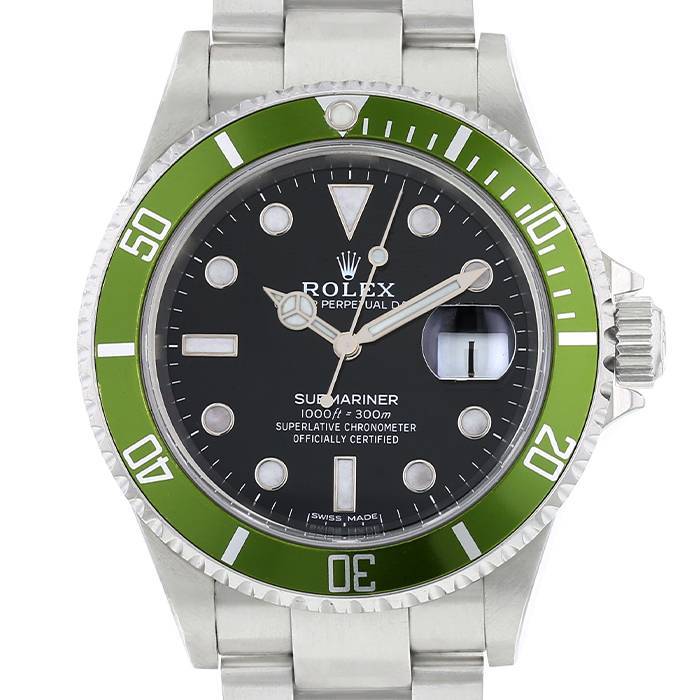

Rolex Submariner Date 40mm SS - Green Bezel - "Kermit" Black... for AED43,454 for sale from a Trusted Seller on Chrono24

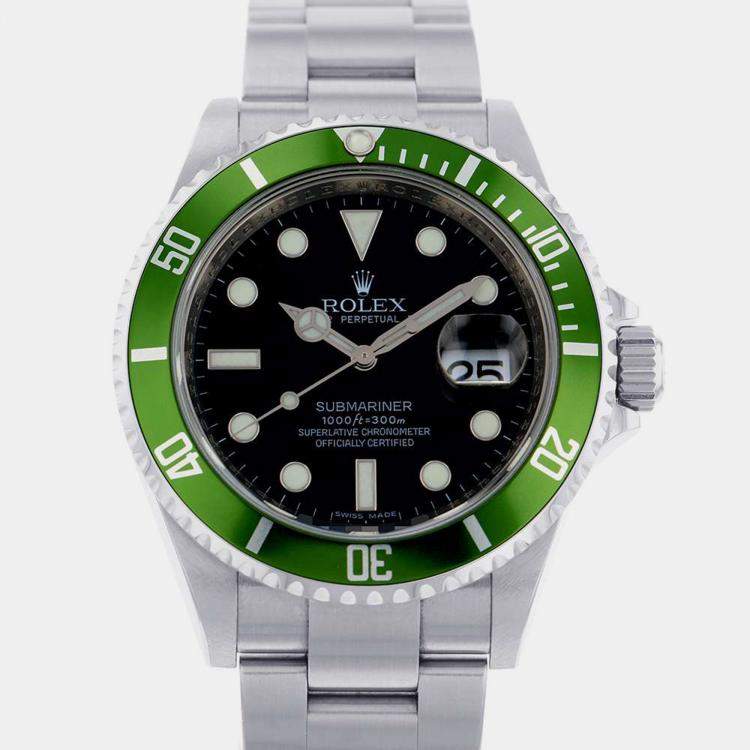

Rolex 16610LV Submariner 50th Anniversary 16610LV SS Green Bezel Mark III dial (43212) | European Watch Co.

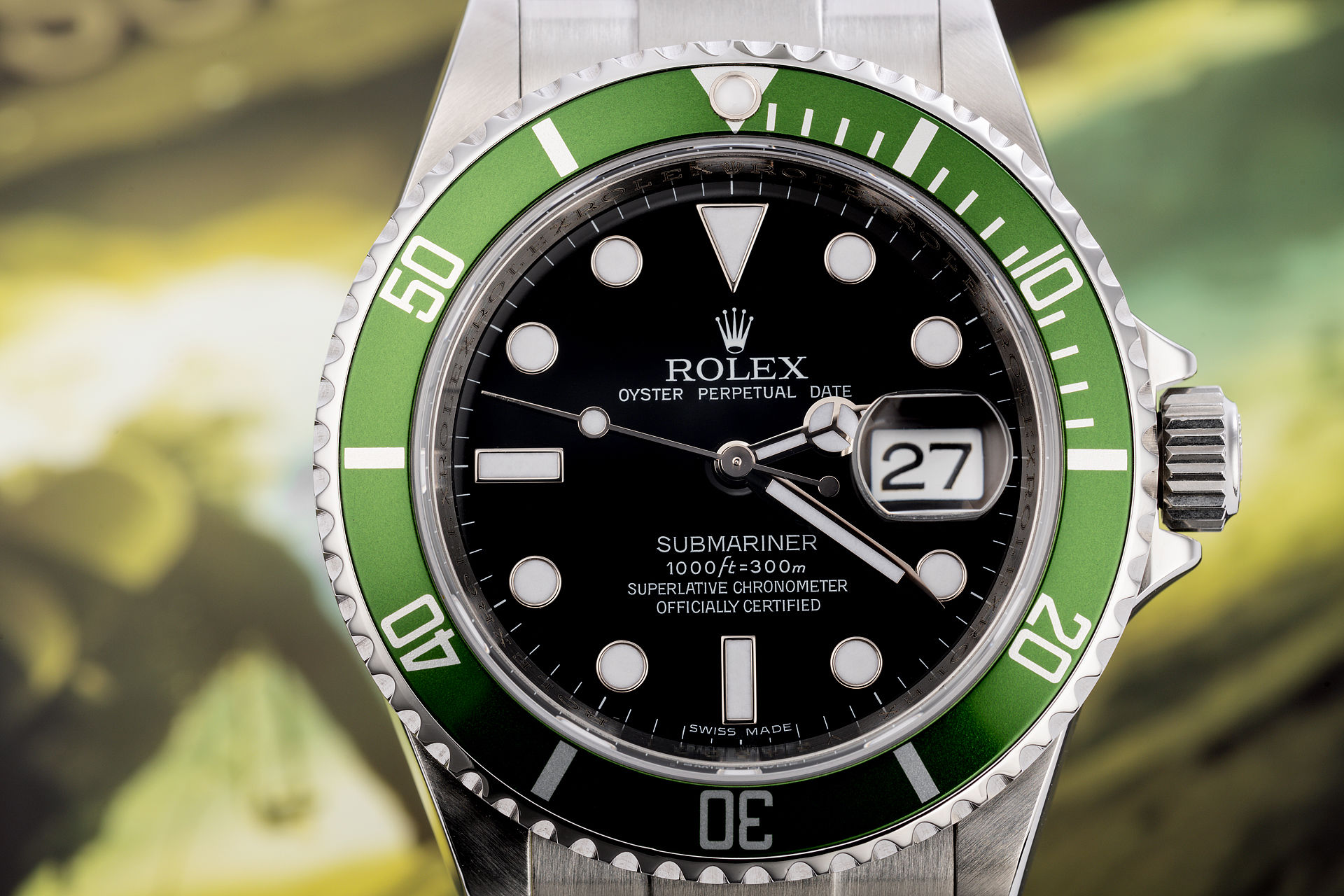

Rolex Submariner Date Kermit 16610LV 40MM Black Dial Box... for AED45,036 for sale from a Seller on Chrono24

![This Is Everything You Need To Know About The Rolex Kermit [REVIEW] This Is Everything You Need To Know About The Rolex Kermit [REVIEW]](https://thewatchlounge.com/wp-content/uploads/2020/01/ROLEX-SUBMARINER-DATE-REF-16610LV-KERMIT-THE-WATCH-LOUNGE-2-scaled.jpeg)