صالة اكرم للمواد الكهرومنزلية والتكييف Home appliances - غسالة صحون hoover صنع ايطاليا 🇨🇮🇨🇮 هوفر HDP3T60PWDX تحتوي على 16نظام استعمال نظام ( WiFi ) تحتوي على نظام التشغيل بكبسة واحدة ( ONE

غسالة صحون ثابتة 5 برامج من هوفر، 12 مكان لوضع الاواني، لون ابيض، صنعت في تركيا، طراز HDW-V512-W : Amazon.ae: الأجهزة

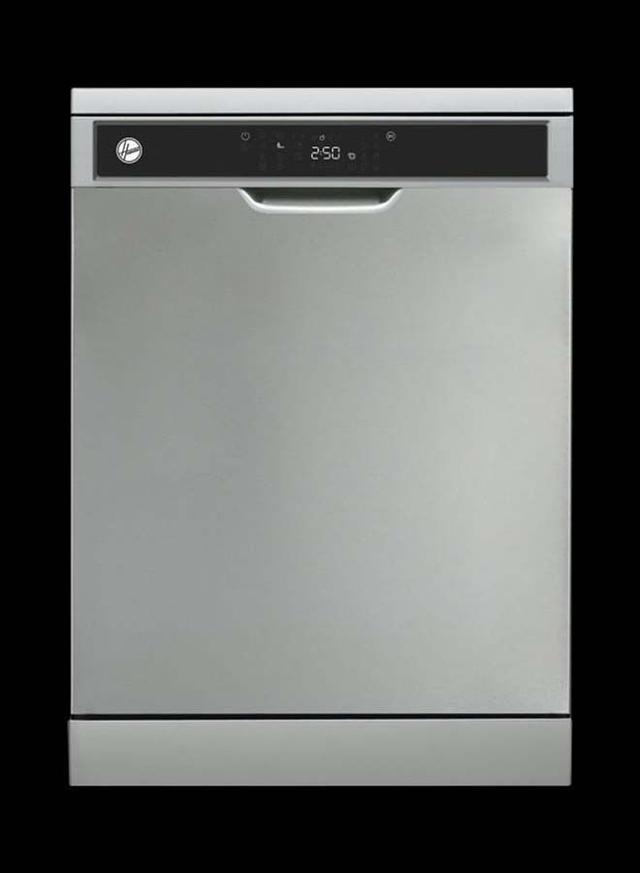

غسالة صحون واقفة بخمسة برامج و12 اعداد مكاني من هوفر - صنعت في تركيا، فضي، HDW1217-S : Amazon.ae: الأجهزة

تسوق جلاية صحون هوفر عدد البرامج 12 بسعة 16 مجموعة أطباق موديل HDPN-4S603PX لون رمادي أون لاين - كارفور الأردن